Tax Credits & Incentives

Climate action tax credits and incentives are financial tools, like rebates, tax deductions, and grants. These programs are designed to help you take meaningful steps toward a more sustainable and resilient future.

Whether you're weatherizing your home, buying an electric vehicle, installing green infrastructure, or reducing waste, there are programs that make it easier and more affordable to act.

Why It Matters

From rising energy costs to extreme weather, climate change is already impacting our communities. These incentives empower individuals, families, businesses, and nonprofits to:

Lower utility bills and fuel costs

Reduce carbon emissions

Improve indoor air quality and comfort

Strengthen climate resilience

Create green jobs and local investment

And with new federal funding through the Inflation Reduction Act and other programs, there’s never been more support for local action.

Resources & Tools

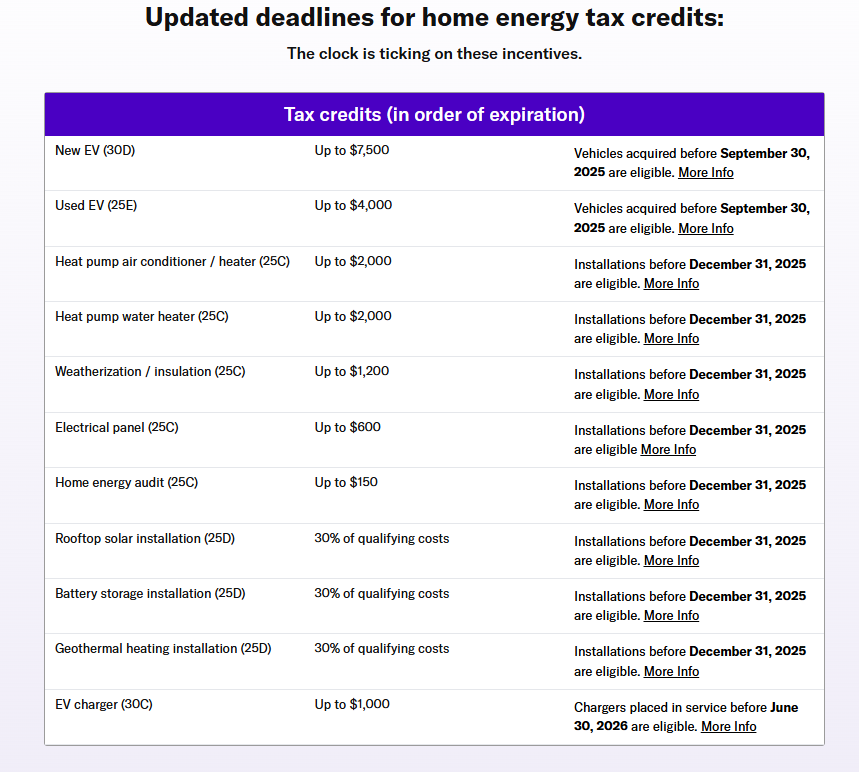

Federal policies are eliminating key energy tax credits sooner than expected, reducing financial support for clean energy upgrades. Act now to take advantage of existing incentives before they expire, and explore additional state and local programs to maximize your savings.

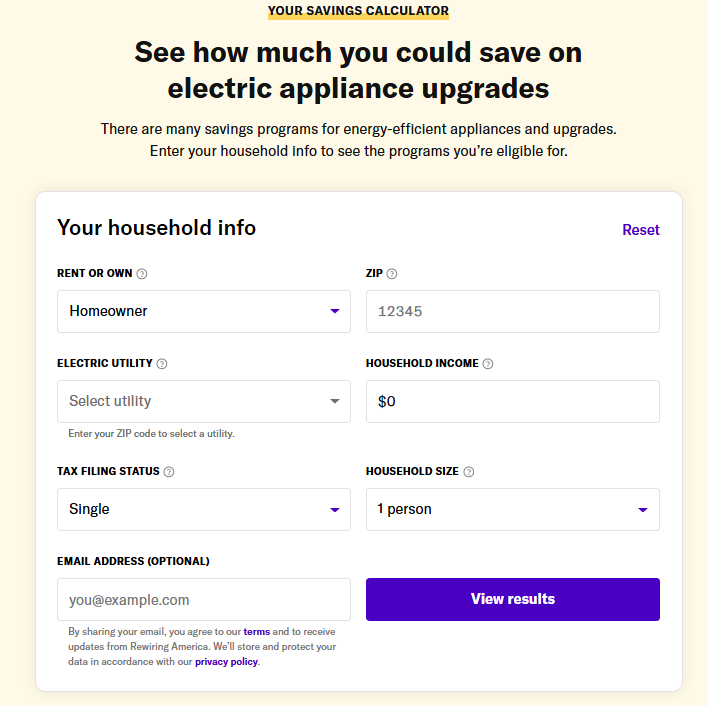

Rewiring America is a nonprofit organization on a mission to electrify everything - homes,  businesses, and communities.

businesses, and communities.

Using their easy-to-use savings calculator, both renters and homeowners can discover what rebates and tax credits they may be eligible for on energy-efficient upgrades like heat pumps, electric stoves, and more.

The ENERGYSTAR rebate finder helps you locate eligible products, installers, and local incentives by zip code to maximize savings.

Homeowners can save up to $3,200 on federal income taxes for energy-efficient home upgrades made through 2025. These tax credits cover 30% of qualified costs for improvements like:

Heat pumps and heat pump water heaters

Insulation, windows, doors, and skylights

Central air conditioners and electric panel upgrades

Biomass stoves, boilers, and furnaces

Home energy audits

Residential clean energy systems (solar, wind, battery storage, geothermal)

Credits are non-refundable and can be claimed using IRS Form 5695. You can combine multiple credits in one tax year, with some annual limits (e.g., up to $2,000 for heat pump technology plus up to $1,200 for other improvements).